The Single Strategy To Use For Feie Calculator

Wiki Article

Feie Calculator for Beginners

Table of ContentsFeie Calculator Things To Know Before You Get ThisNot known Incorrect Statements About Feie Calculator Little Known Questions About Feie Calculator.The Basic Principles Of Feie Calculator The Ultimate Guide To Feie CalculatorThe Facts About Feie Calculator RevealedThe Basic Principles Of Feie Calculator

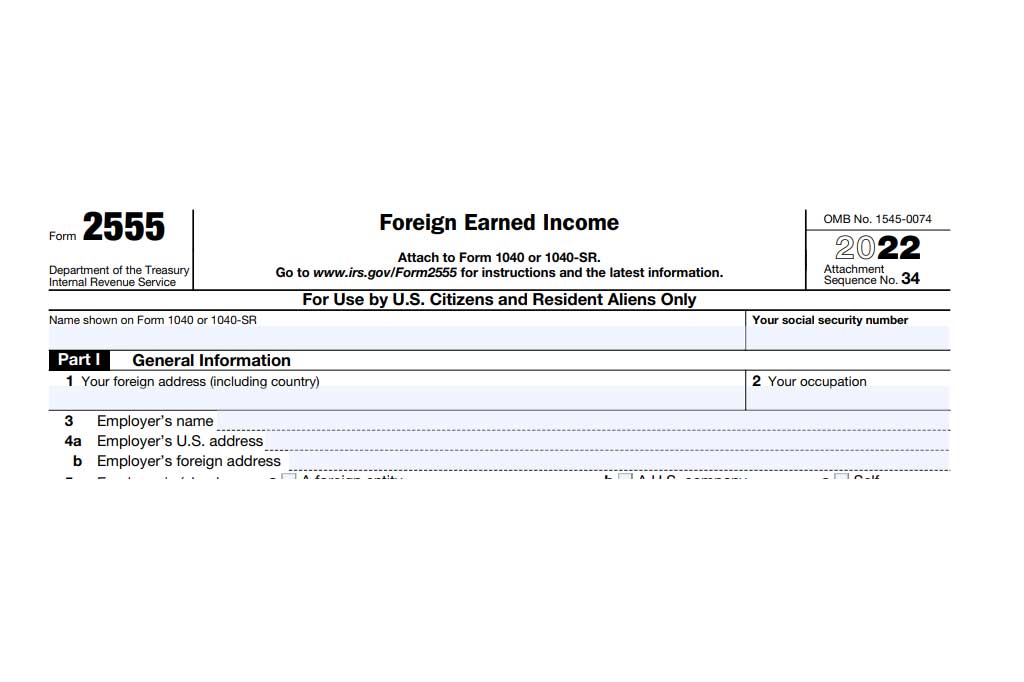

If he 'd regularly taken a trip, he would certainly rather finish Component III, providing the 12-month period he satisfied the Physical Visibility Examination and his traveling history. Action 3: Coverage Foreign Earnings (Component IV): Mark earned 4,500 per month (54,000 yearly).Mark determines the exchange price (e.g., 1 EUR = 1.10 USD) and transforms his wage (54,000 1.10 = $59,400). Since he lived in Germany all year, the percent of time he resided abroad during the tax is 100% and he gets in $59,400 as his FEIE. Lastly, Mark reports total earnings on his Kind 1040 and goes into the FEIE as a negative quantity on time 1, Line 8d, lowering his gross income.

Picking the FEIE when it's not the most effective alternative: The FEIE might not be perfect if you have a high unearned earnings, make greater than the exemption limitation, or stay in a high-tax country where the Foreign Tax Credit Score (FTC) might be more beneficial. The Foreign Tax Credit Rating (FTC) is a tax reduction method frequently utilized in conjunction with the FEIE.

Getting The Feie Calculator To Work

expats to counter their united state tax obligation financial obligation with foreign revenue taxes paid on a dollar-for-dollar reduction basis. This implies that in high-tax nations, the FTC can usually get rid of U.S. tax debt totally. However, the FTC has constraints on eligible tax obligations and the maximum case amount: Qualified taxes: Only revenue tax obligations (or taxes instead of income tax obligations) paid to foreign governments are qualified.tax obligation obligation on your international income. If the international taxes you paid surpass this limit, the excess foreign tax can typically be lugged forward for up to 10 years or lugged back one year (via a modified return). Preserving precise documents of international revenue and taxes paid is as a result crucial to computing the correct FTC and keeping tax compliance.

migrants to lower their tax responsibilities. For circumstances, if a united state taxpayer has $250,000 in foreign-earned revenue, they can exclude up to $130,000 making use of the FEIE (2025 ). The remaining $120,000 may after that go through taxes, yet the U.S. taxpayer can possibly apply the Foreign Tax obligation Credit history to counter the taxes paid to the foreign nation.

Unknown Facts About Feie Calculator

He offered his United state home to establish his intent to live abroad completely and applied for a Mexican residency visa with his better half to aid accomplish the Bona Fide Residency Examination. Neil points out that purchasing residential or commercial property abroad can be testing without very first experiencing the location."We'll definitely be outside of that. Even if we come back to the US for physician's consultations or business phone calls, I doubt we'll spend even more than thirty days in the United States in any offered 12-month period." Neil highlights the value of rigorous tracking of U.S. gos to. "It's something that individuals require to be actually persistent regarding," he claims, and advises expats to be mindful of common blunders, such as overstaying in the united state

Neil bewares to stress and anxiety to U.S. tax authorities that "I'm not performing any kind of organization in Illinois. It's just a mailing address." Lewis Chessis is a tax obligation advisor on the Harness system with extensive experience aiding united state residents browse the often-confusing realm of worldwide tax obligation compliance. Among the most typical false impressions amongst U.S.

Feie Calculator - An Overview

income tax return. "The Foreign Tax Credit permits people operating in high-tax nations like the UK to offset their united state tax obligation by the amount they have actually already paid in taxes abroad," says Lewis. This guarantees that deportees are not exhausted two times on the very same income. However, those in reduced- or no-tax countries, such as the UAE or Singapore, face added obstacles.

The possibility of reduced living prices can be tempting, but it typically features trade-offs that aren't immediately apparent - https://lizard-mechanic-776.notion.site/Foreign-Earned-Income-Exclusion-How-Digital-Nomads-and-American-Expats-Can-Ditch-the-Tax-Burden-240d0ece9741801892a2f0b3d5101c89?source=copy_link. Housing, for instance, can be a lot more economical in some nations, but this can indicate endangering on framework, safety, or accessibility to reliable energies and solutions. Inexpensive properties may be found in areas with inconsistent internet, limited mass transit, or unstable medical care facilitiesfactors that can substantially influence your everyday life

Below are a few of the most frequently asked concerns about the FEIE and other exemptions The International Earned Earnings Exclusion (FEIE) permits united state taxpayers to omit up to $130,000 of foreign-earned income from government income tax, decreasing their U.S. tax liability. To receive FEIE, you must fulfill either the Physical Existence Examination (330 days abroad) or the Bona Fide Residence Test (prove your key home in an international country for a whole tax year).

The Physical Presence Examination needs you to be outside the U.S. for 330 days within a 12-month duration. The Physical Existence Examination also calls for U.S. taxpayers to have both an international revenue and a foreign tax obligation home. A tax home is specified as your prime area for service or work, despite your family members's house. https://feiecalcu.carrd.co/.

The smart Trick of Feie Calculator That Nobody is Discussing

An income tax treaty between the U.S. and an additional country can help prevent double tax. While the Foreign Earned Revenue Exemption lowers gross income, a treaty might offer added benefits for eligible taxpayers abroad. FBAR (Foreign Savings Account Record) is a called for declare U.S. residents with over $10,000 in foreign monetary accounts.

Neil Johnson, CERTIFIED PUBLIC ACCOUNTANT, is a tax obligation expert on the Harness system and the owner of The Tax Dude. He has over thirty years of experience and now focuses on CFO solutions, equity payment, copyright tax, cannabis tax and divorce associated tax/financial planning matters. He is a deportee based in Mexico.

The international gained earnings exclusions, sometimes referred to as the Sec. 911 exclusions, exclude tax on incomes made from functioning abroad.

The Buzz on Feie Calculator

The tax advantage leaves out the revenue from tax obligation at lower tax obligation prices. Previously, the exclusions "came off the top" lowering income topic to tax obligation at the leading tax obligation prices.These exemptions do not exempt the earnings from United States tax yet just give a tax reduction. Note that a single person working abroad for all of 2025 that gained about $145,000 with no various other earnings will certainly have gross income minimized to zero - successfully the very same response as being "tax obligation free." The exclusions are computed on a daily basis.

If you attended organization meetings or workshops in the United States while living abroad, income for those days can not be left out. For US tax it does not matter where you maintain find out your funds - you are taxable on your globally earnings as an US individual.

Report this wiki page